Navigating the Economic Landscape | Insights from Q1 2024

The first quarter kicked off with a subdued pace, a contrast to the momentum of 2023's remarkable performance. A temporary lull in market growth seemed anticipated, yet a shift occurred with the emergence of "positive" economic indicators and Federal Reserve remarks, propelling markets upward as the curtain fell on the initial quarter of this pivotal election year. What initially resembled the Magnificent Seven soon evolved into the Mag-4. Interest rates remain a focal point for investors across both fixed-income and equity markets. Amidst these fluctuations, the political landscape for 2024 presents a mix of continuity and change, offering investors both familiar ground and new horizons to navigate.

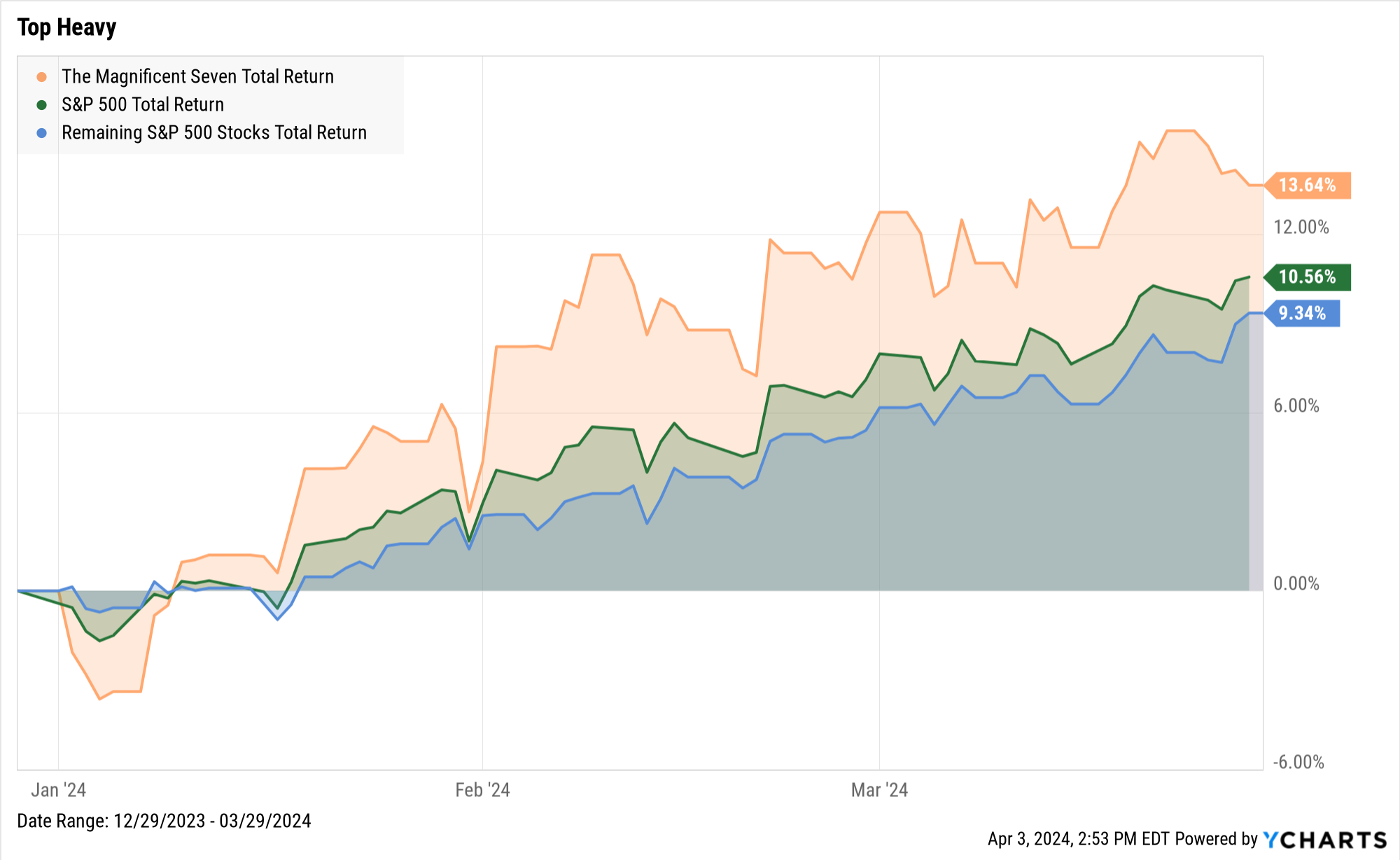

The prominence of certain names in the S&P 500 has become a familiar refrain, yet the fervor surrounding these top stocks shows no signs of abating. Particularly, tech firms with exposure to Artificial Intelligence (AI) have particularly influenced the index, driving it to new highs. Following a stellar 24% surge in 2023, the top 500 companies, by market cap, continued their ascent with a robust 10.56% return in the initial quarter. While the spotlight shines brightest on the leading players, other stocks within the index displayed resilience, notching a commendable 9.34% gain of their own. However, not all leaders managed to maintain their trajectory. Those less reliant on AI hype and more focused on product innovation face the challenge of proving their ability to meet investor expectations amidst a backdrop of stringent financial conditions.

Financial conditions appear set to maintain their tight grip for the foreseeable future. At the onset of the year, expectations in the fixed-income realm centered around a series of anticipated rate cuts from the Federal Reserve. However, the resilience of the jobs market, with unemployment holding steady below 4%, has thwarted hopes of a swift return to the Fed's 2% inflation target. Amidst this backdrop, divergent views emerge: some advocate for patience, while others speculate that the Fed may recalibrate its target upwards to declare partial success in meeting its mandate. Concerns loom among economists regarding the specter of a wage-price spiral, a dreaded scenario where increasing real wages, coupled with robust labor demand, perpetuate elevated price levels, leaving the Fed with little room to maneuver on interest rates. Fortunately, the Fed's outlook diverges from this worrisome narrative. While employment figures continue to expand, the pace of growth is decelerating, mirrored by a moderation in wage increases. Nonetheless, the Fed remains committed to curbing inflationary pressures before contemplating any relaxation of financial conditions. It's worth noting that while current interest rates are elevated compared to recent history, historical precedent suggests that the economy can operate efficiently with rates at or above current levels. Thus, barring an unforeseen economic calamity, a return to near-zero interest rates is not on the horizon.

The stage seems set with contenders vying for the highest office in the land. With each passing day, political rhetoric is poised to escalate as we march towards November. Regardless of the eventual winner, formidable challenges lie ahead on the horizon. From a burgeoning deficit to the specter of Social Security insolvency and escalating global unrest, the incoming administration will inherit a complex landscape demanding leadership, as unlikely as we are to get it. From an investor's perspective, the primary concern is policy clarity. Will tax policies undergo revision? Can our nation sustain its current debt levels? Clarifying these uncertainties will enable businesses to chart their course with confidence. History suggests that election years often bring positive outcomes for markets, underscoring the resilience of businesses in navigating the evolving political landscape, regardless of the combination of executive and congressional control.

Our goal remains to steward wealth creation by investing in great companies. As financial conditions remain stringent and headlines chase election narratives, investors need not follow day-to-day market moves. Stick with your plan.