How Much Do I Need to Retire?

How much money do you need for retirement? That's the question many people ask, and fortunately, the answer is quite simple. You need a pile of assets large enough that allows you to withdraw no more than 5% from that pile each year to cover your lifestyle expenses and living costs.Let's break it down. Say you require $90,000 per year ($7,500 per month) to live comfortably in retirement, and you have the following sources of income totaling $90,000: Social Security ($30,000), Pension Income ($10,000), and Portfolio Income ($50,000).

In this scenario, $40,000 of your annual living expenses are already covered by Social Security and Pension Income. To maintain a comfortable lifestyle, you'll need to generate the remaining $50,000 from your pile. So, how big does that pile need to be? Well, to generate $50,000 of income from your portfolio, it should be worth at least $1,000,000 at the time of your retirement. This is because $50,000 is 5% of a $1,000,000 portfolio.

Now, you might think that reaching a million-dollar portfolio is difficult, but it's not as challenging as it may seem. If you save and invest $8,900 annually for 30 years (from age 35 to 65), you should accumulate $1,000,000 in your account. Assuming an average annual return of 8% (historically, the S&P 500 has averaged around 10% over the long term), this goal is achievable.

So Why Should You Aim for a 5% Withdrawal Rate?

You might be wondering why we use a 5% withdrawal rate and whether 4% is better. Different experts may have varying opinions on what constitutes a "safe" withdrawal rate. Generally, the lower the withdrawal percentage, the more conservative and preferable it is. Using the example above for instance, if you have a portfolio worth $2,500,000 withdrawing $50,000 means you're only utilizing 2% of your portfolio value. This conservative rate puts you in a better position when entering retirement. Certainly, no one has ever complained about saving too much for retirement, so saving more to stay below the 5% withdrawal rate is excellent and encouraged.

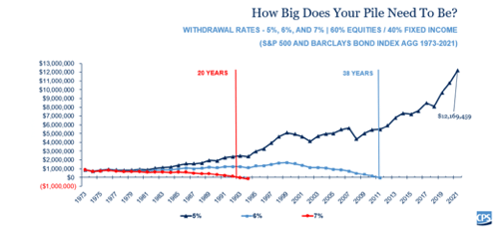

However, you may wonder why we consider 5% the maximum withdrawal rate. Why not 6%? We conducted calculations using a 5% withdrawal rate, even in unfavorable retirement scenarios. Let's assume you retired on January 1st, 1973, with $1,000,000. See the chart below for more details:

Do a quick Google search and you’ll find that in 1973 inflation was above 6%, the Fed Funds rate was above 8% and the S&P 500 was down nearly 15%! What’s even worse is that in 1974 the S&P 500 dropped just over 26%. This means that between 1973 and 1974, right after you retired, your portfolio would have experienced a decline of more than 40%. That's a significant blow!

In 1973, you would have withdrawn $50,000 from your pile to cover living expenses, but in 1974, needing to adjust for inflation, you would have withdrawn another $50,000 plus an additional $1,550. The following years would be no different as you would continue to withdraw over $50.000 from your pile continuously adjusting for inflation.

As the chart illustrates, a withdrawal rate of 5% allows your assets to grow despite these unfavorable retirement scenarios. While withdrawing higher than 5% eventually would have depleted your savings.

Your retirement goal is to build a substantial portfolio that covers your living expenses with a withdrawal rate of no more than 5%. Ideally, you should aim to have a portfolio that allows for a withdrawal rate lower than 5% during retirement. It's important to note that this article does not address other risk factors or unexpected events that may occur during retirement. Its purpose is to provide general guidance on the amount of money needed for retirement. For personalized advice or if you have specific questions, please consult with a CPS advisor.