IRA vs. Roth IRA - What is the Difference?

Question – “What is the difference between a Traditional Individual Retirement Arrangement (IRA) and a Roth Individual Retirement Arrangement (Roth IRA)?”

Answer – The primary difference is the tax treatment of the accounts in three key areas:

- Contributions

- Growth

- Withdrawals

Contributions

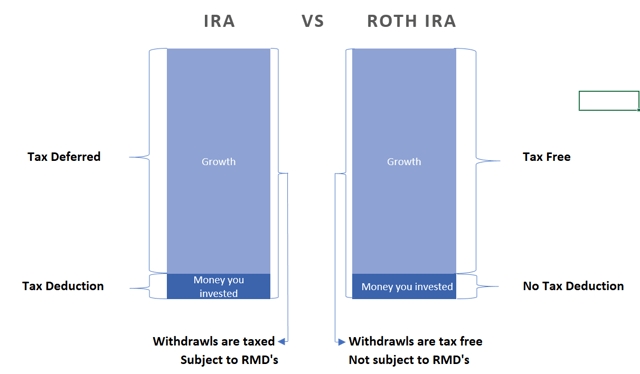

If eligible, contributions to both an IRA and Roth IRA, are capped at $6,000 ($7,000 if age 50 or older) each year. The tax treatment of the contributions differs greatly between both types of accounts. Assuming you are eligible, the traditional IRA allows for a tax deduction the year that you put the money in to the account. In other words, you can “write-off” your contribution on your tax return and receive an immediate tax benefit. On the other hand, a Roth IRA does not allow for a tax deduction when you put funds into the account. Simply stated: The contribution to a Traditional IRA is tax deductible while the contribution to a Roth IRA is not.

Growth

Once you have contributed to the accounts, the next concern is the tax impact of growth within the accounts. Let’s start with a Traditional IRA. The growth of your money within a traditional IRA is tax deferred. Meaning, you are delaying when you will pay the tax. Example: if you put $6,000 into your traditional IRA and after 10 years it grew to $12,000 you would not owe any tax while the account was growing. The taxes are delayed until you start to withdraw from the account. We will discuss withdrawals a bit further in the next section. Conversely, a Roth IRA grows tax-free. Meaning… tax free. Example: if you put $6,000 into a Roth IRA and after 10 years it grew to $12,000 you would not owe tax on the growth. There are a few exceptions to the tax free growth, but in general, the growth is tax free. So to recap, a traditional IRA has tax deferred growth, while a Roth IRA has tax free growth.

Withdrawals

The final difference is the tax treatment of withdrawals from each account. Let’s first start with a Traditional IRA. Withdrawal’s from this type of account are taxable to you. Meaning, the amount that you pull out of the Traditional IRA is included in your taxable income and subject to tax. You may be thinking, “I can avoid paying the tax, if I never pull money from my traditional IRA. Correct?” Good try, however the IRS will require you to take a portion of the funds out of your traditional IRA when you reach the age of 72. This is called a Required Minimum Distribution or (RMD) for short. Alternatively, a Roth IRA is not subject to tax when withdrawals occur from this type of account. (Assuming no exceptions apply) This also means that a Roth IRA is not subject to RMD’s. In short, a traditional IRA has taxable withdrawals, and a Roth IRA has tax free withdrawals.

Overall, each account type has advantages and disadvantages. To help decide the best account type for you, please consult with your advisor. If you would like to meet with one of our CPS Advisors, you can reach out to info@cpsinvest.com. Thank you!